Analysis of SAP SD Document with Regard To Credit Management

Analysis of SAP SD Document with Regard To Credit Management using CHECK_CM

Why is SAP Credit Management Check Analysis Required?

As we know SAP Credit checks are applied to SAP Sales Order, Delivery, and PGI level. As per client requirements, we may apply different types and different factors of credit checks for these levels.

After the creation of SAP sales Order, Delivery and PGI if the client or any consultant wants to know a few details about credit check against SD documents such as.

Business wants Below Details About The Credit Check

- What type of credit check is applied to SD Documents?

- What are the factors applied to SD documents?

- How does the liability amount affect the credit limit?

- Why sap credit check failed?

The Consultant Wants To Know Below Details

Along with business details, consultants want to analyze the Customizing settings relevant for credit management.

- Settings for a SAP Credit check.

- How is the credit control area determined for SD documents?

- Which credit group applied to the SD document?

- How is the Risk Category determined for an SD document?

- Which type of Credit check applied?

- How does credit value update into info structure?

To get the answer to the above queries of users or consultants, we can use SAP provided standard program CHECK_CM.

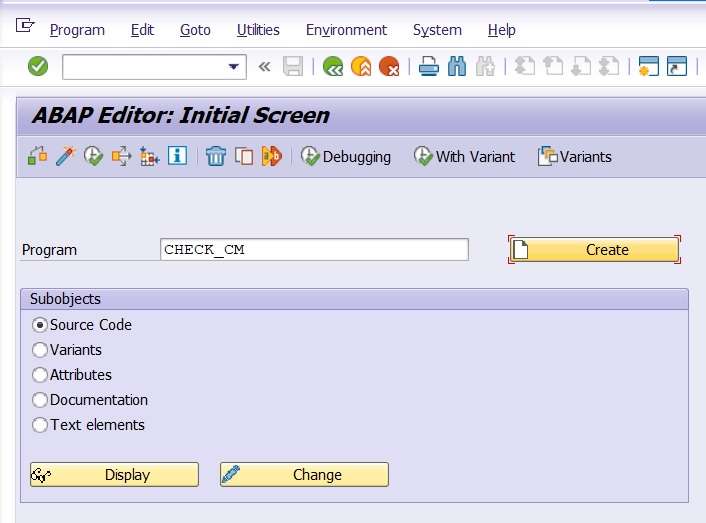

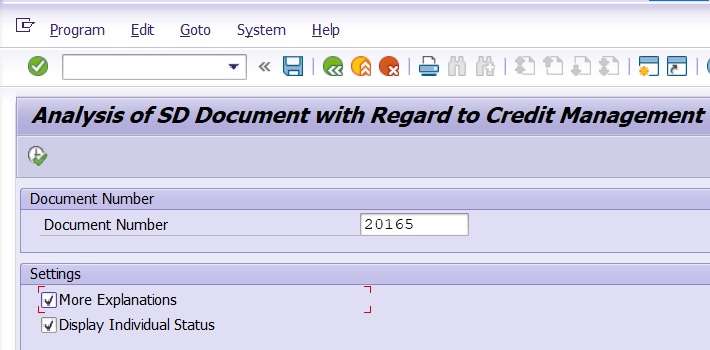

Use T.Code either SE38 or SA38

Program Name:- CHECK_CM

Click on Execute

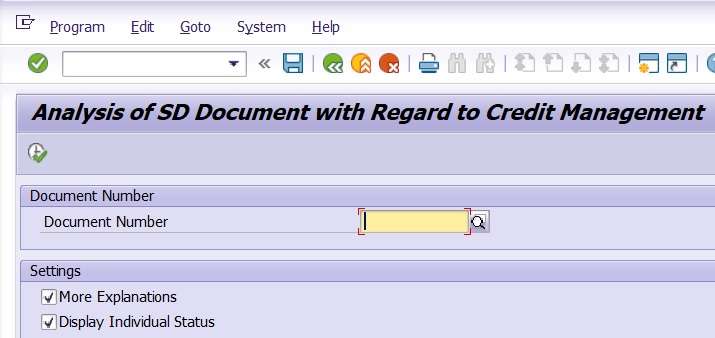

Then click on Execute or press the “F8” button.

Testing Scenario for Sales Order

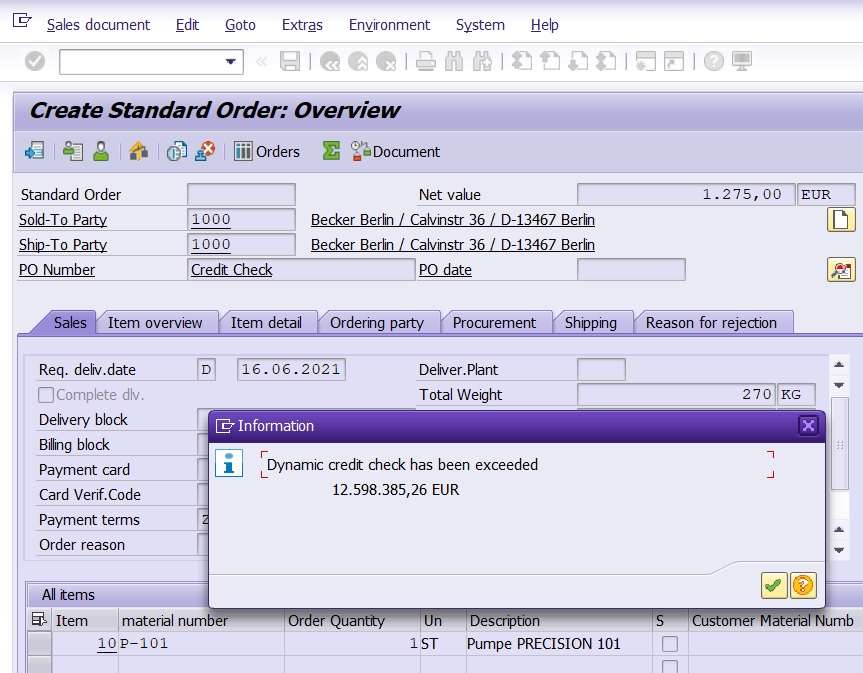

Step1:- Sales Order Creation [VA01]

Step2:- Credit Check Analysis CHECK_CM

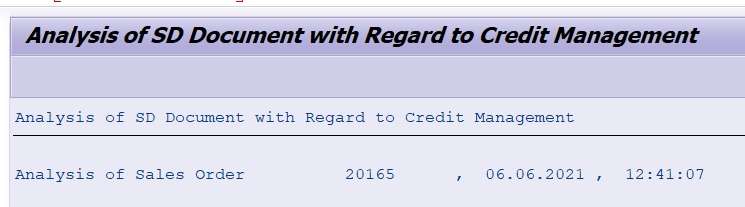

Analysis of Sales Order

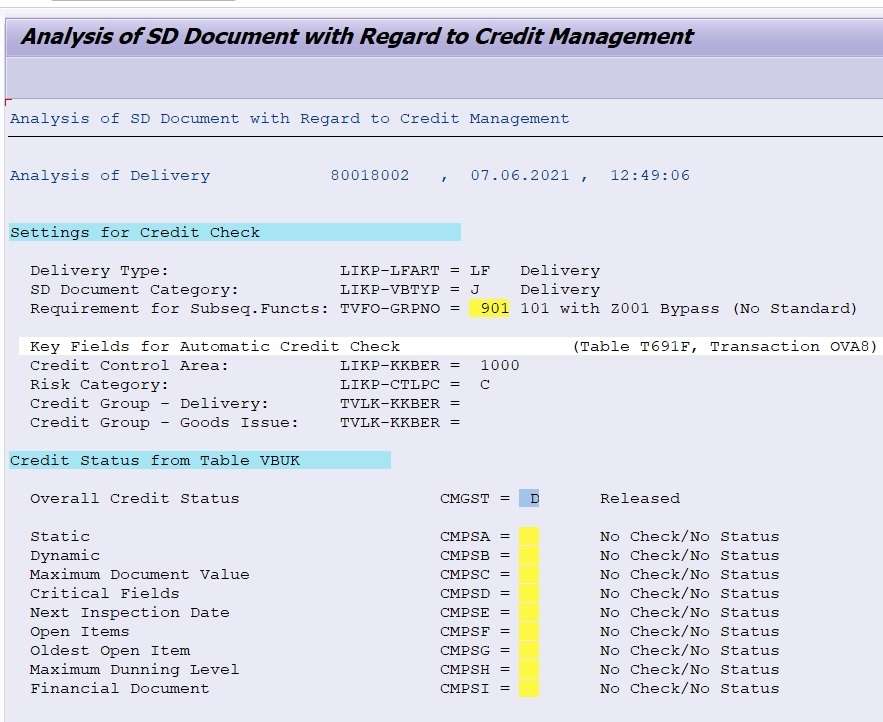

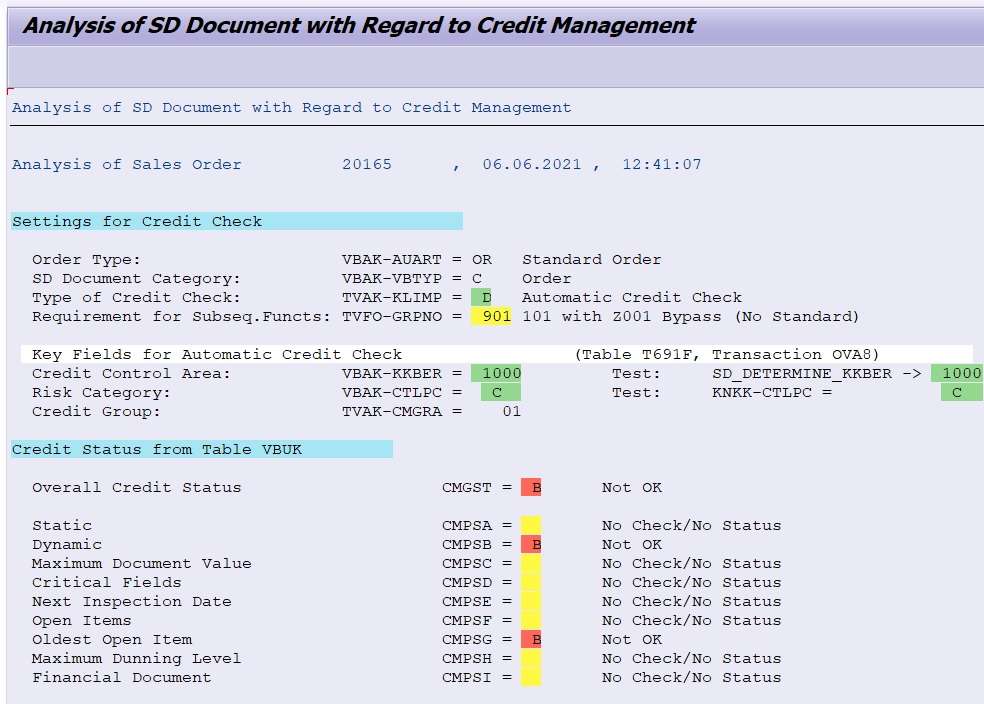

Such a report tells about specific SD document numbers and which date and time because even though your sales document is the same, its value may change as and when users change or modify anything in that document. Therefore this report displays the date and time.

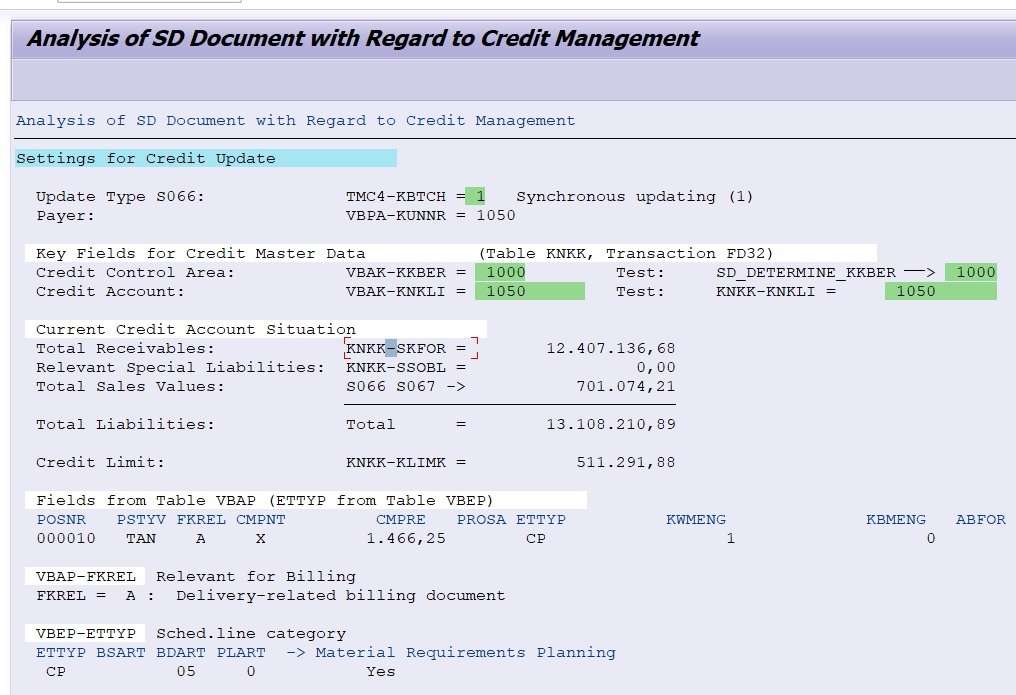

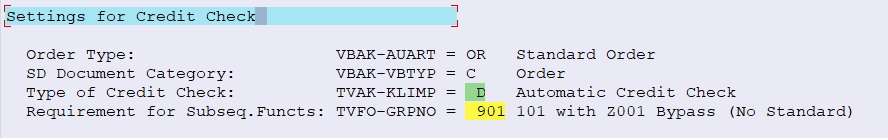

Settings for SAP Credit Check

- Order Type or Document type

- SD Document category of Document type

- Type of Credit check applied to SD document.

Key Fields for Automatic Credit Check in OVA8

Settings for determining the credit control area of a document

In this section, the system displays how below Credit Management factors are determined in Document. Below mentioned factors are maintained or configured in OVA8.

- Credit Control Area determined in Sales document VBAK-KKBER

- Risk Category

- Assignment this risk category to a credit account FD32 = KNKK-CTLPC

- The risk category in the sales order field VBAK-CTLPC

- Credit group stands for documents like sales order, Delivery and PGI.

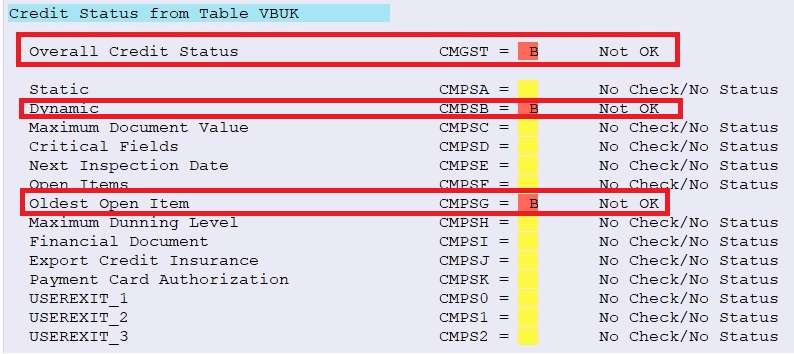

Credit Status from VBUK

If one of the checks has a ‘Not OK‘ result, the overall status will also be ‘Not OK‘ = Credit blocked.

Credit status information gives us detailed settings of OVA8 so no need to check OVA8 configuration settings in the production system.

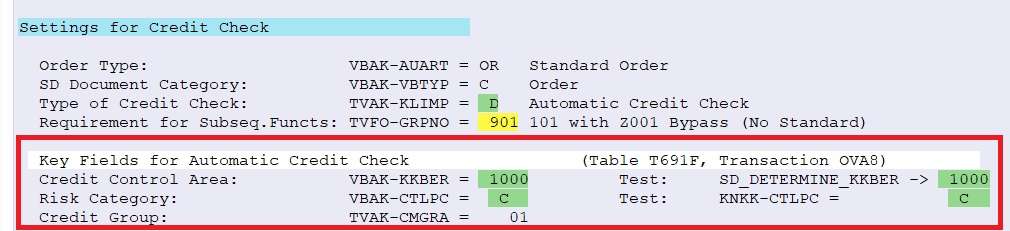

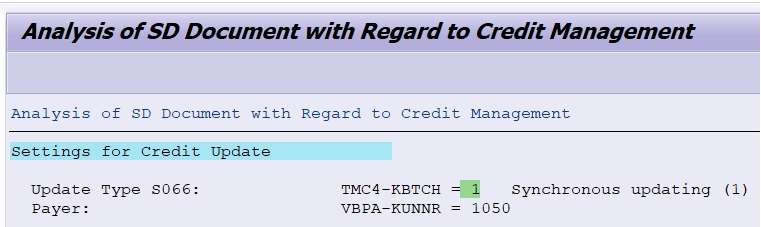

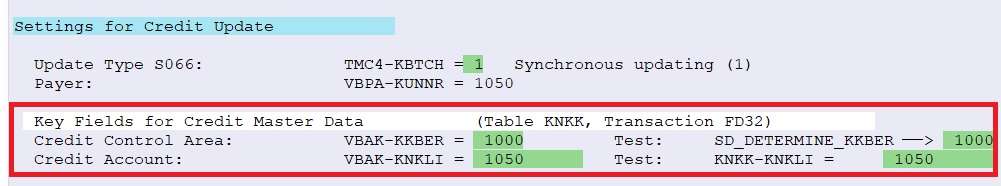

Setting for Credit Update

Info-Structure

The above section tells that credit value is updated into which info structure like SO66 and SO67, and which method is either synchronous or Asynchronous.

Payer

Credit value updated info structure against which payer.

Key Fields for Credit Master Data from FD32

Credit Account:

- Credit accounts may be different from those sold to the party and Payer.

- Credit Account derives from credit master data.

- If the credit account was changed since the sales document creation, you can see the field VBAK-KNKLI and KNKK-KNKLI in red.

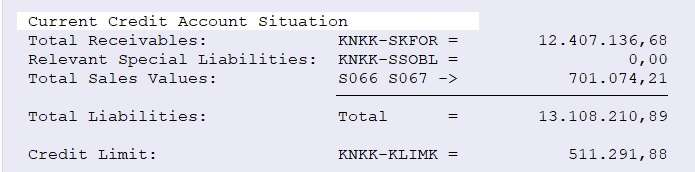

Current Credit Account Situation

It tells about what is the current credit situation of the concerned Credit Account.

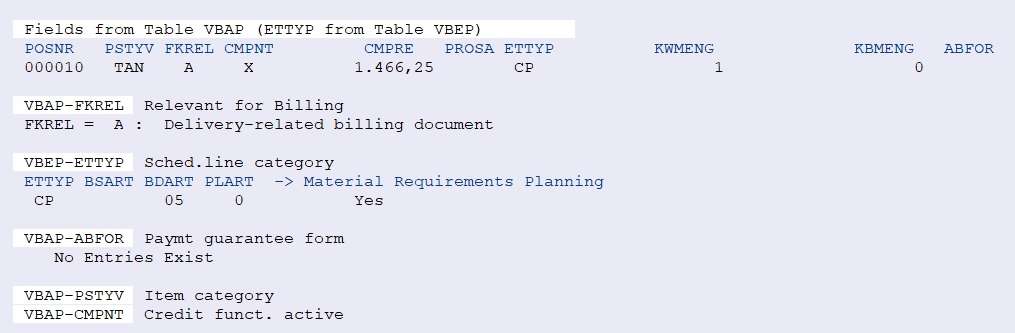

Fields from Table VBAP (ETTYP from Table VBEP)

From SD Document which line items are related to credit management, these are displayed in this section with its net value and schedule line category details. Analysis of Delivery document

In this way, by using the program CHECK_CM, you can analyze SD documents for credit management to know how SAP credit management works for your sales process and help provide information to your client during your support activities. still, if you want to know more about analysis refer below SNOTE.

1479897 – How to use report CHECK_CM

Join Our SAP SD LinkedIn Group